So, recently I got wind of a new brokerage opening in Singapore. They offers competitive commission and under current promotion a free stock if you deposit at least S$1000 during account opening. Don't get your hopes up too much though as I only received a single F (Ford).

In case you're interested to open a new Tiger Brokerage account, you can use my referral code for a free stock

Referral Code Link

They're backed by Interactive Brokers and it also seems that they're using Interactive Brokers back end. It can get quite confusing for new users so I will try to give a tutorial on how to deposit money into Tiger Brokers.

1. Go to "Me" and Click on "Account Summary"

2. In Account Summary screen, click on "Fund Deposit"

3. Here in the Deposit screen, we have to select the currency that we want to use for funding. I'm choosing SGD as I only have SGD bank account

4. In "Remittance", it will only display the bank and account number of Tiger Brokerage. So just make sure you have added them as a recipient in your online banking account. When you transfer your money to them, remember to screenshot the receipt as you will need them in the next step.

You have to click on "Funds Remitted, inform Tiger to check" to proceed.

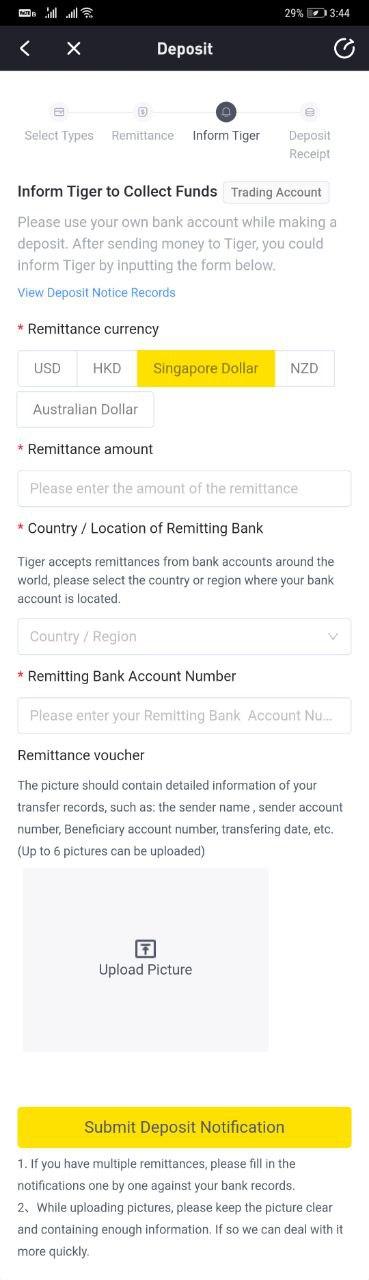

5. It's a bit mafan here but basically you have fill in your remittance currency, remittance amount, country, bank account number and upload your transfer receipt. Click "Submit Deposit Notification" and you're done.

6. So I can start trading now right? Not so fast! It's not instantaneous and you do have to wait for them to verify your transfer. In my experience it usually takes an hour if you deposit during working hours.

Another thing to note is for all IB (Interactive Broker) based platforms, when they receive your fund deposit it will be in ORIGINAL currency. So if you deposit SGD, it will be stored in as SGD. If you would like to trade in USD or HKD you will have to exchange your SGD to USD/HKD.

So you have to navigate to "Account Summary" and click on "Currency Exchange".

Then you just input your SGD amount to exchange. I find the exchange rate is quite good although there is a US$2 fee on every transaction. Yet another thing to note is you can't exchange SGD directly to HKD. Why? I don't know.

Comments

Post a Comment