So, this is the second post in the series of my attempt to construct my own ARK Innovation ETF. I actually have other counters in mind, but I can't reveal my cards before I am in my positions yet. I promise you it's not all Chinese companies, but these are the ones I have decided to invest on as usually Chinese companies are relatively undervalued compared to their American counterparts. That doesn't mean that As China and the United States are the two biggest economy and the most innovative countries in the world, the counters will skew heavily towards them.

What is GDS?

GDS is a data centre operator from China. Note that unlike other competitors, it's not a REIT. Hence, unlike Digital Realty (DLR) and Equinix (EQIX), GDS does not have the obligation to pay 90% of their taxable income as distributions (dividends)

Disclaimer : My cost price on this counter is 63.58 having average up once at $80.

Who are the shareholders?

As you can see, STT has 34% shares. STT is ST Telemedia and it's owned by Temasek. If you're not from Singapore and you don't know what Temasek is, it's Singapore's Sovereign Wealth Fund. They're quite famous for growing their investment capital. That's not to say everything they touch turn to gold, but I'd say they have a good track record. Unlike Nio where they trim their holdings, ST Telemedia actually has a big 34% stake in GDS.

Why you should invest in data centre companies?

- China is currently in a 'new' infrastructure drive and cloud computing has been identified as one of the pillars of 'new' infrastructure. This will result in more demand for data centres. So, I think data centre companies should be considered as a growth company. 5G adoption will driver more usage of data and this will cause a higher demand on data centre capacaties.

- COVID-19 pandemic has wreck havoc on our way of life and there's no guarantee that it will return to normal ever. Data centres definitely won't be affected much. In fact, it may also increase revenues for them.

- Increasing revenues.

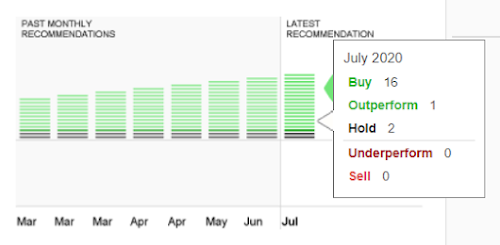

- It holds 16 buy recommendations and 0 sell recommendations.

What I don't like from GDS

- As usual with Chinese companies listed on Nasdaq, there is a risk of delisting.

- High interest expense and debt

My thoughts

From the cash flow statement, we can see that GDS is still expanding and investing like crazy

From the following statement, we can see that although GDS is still losing money, the bulk of it is coming from depreciation and amortisation.

The next earnings call for GDS will be on 6th August 2020. Personally, if I had the moolah, I would buy whenever there is a dip and I'll be keeping this for long term.

As always do your own due diligence. This is not a buy/sell call

Comments

Post a Comment